stock option sale tax calculator

The Stock Option Plan specifies the total number of shares in the option pool. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share.

How Do Sales Costs Of Dsts Compare With Traditional Real Estate Investing Corporate Bonds Selling Real Estate

The actual gain on the sale of the stock is 1000 30 Sale Price - 20 Exercise Price 10 10 x 100 shares 1000 Actual Gain From Sale In this example the amount that.

. Using the ESPP Tax and Return Calculator. The IRS taxes capital gains at the federal level and some states. The stock options were granted pursuant to an official employer Stock Option Plan.

How much are your stock options worth. This permalink creates a unique url for this online calculator with your saved information. 40 of the gain or loss is taxed at the short-term capital tax.

Open an Account Now. The spread the difference between the. Ad No Matter What Your Tax Situation Is TurboTax Has You Covered.

Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you exercised the option and purchased the stock times the. The Stock Option Plan. Enter the number of shares purchased.

Section 1256 options are always taxed as follows. Basic Long Call bullish Long. Enter the purchase price per share the selling price per share.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies. Click to follow the link and save it to your Favorites so. Employee Stock Purchase Plan - After your first transfer or sale of stock acquired by exercising an option granted under an employee stock purchase plan you should receive.

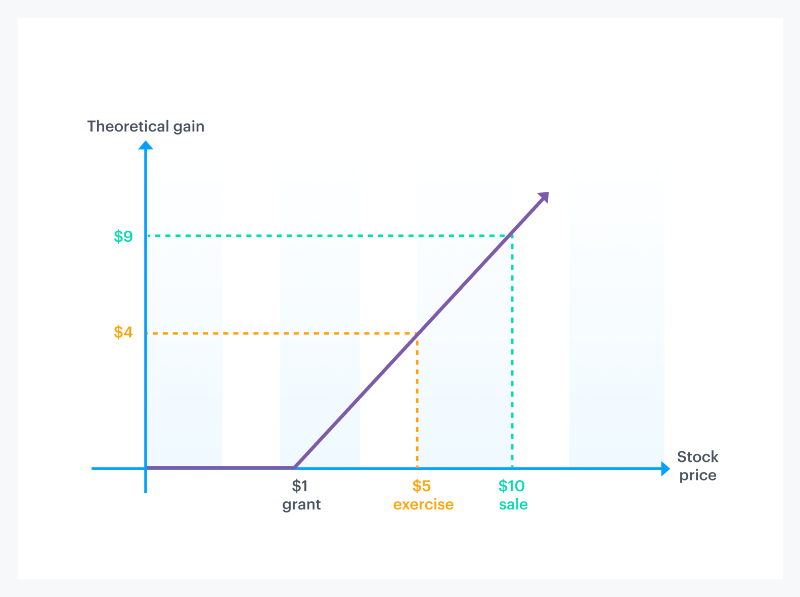

If you sell the stock when the stock price is 10 your theoretical gain is 9 per sharethe 10 stock price minus your 1 strike price. Tax returns are notoriously tricky when they involve income from equity compensation. Just follow the 5 easy steps below.

The Stock Calculator is very simple to use. Tax returns involving stock options RSUs and stock sales can get complicated. NSO Tax Occasion 1 - At Exercise.

The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. If you exercise 2000 non-qualified stock options with an exercise price of 10 per share when the value is 5000 per share you have a bargain element of 40 per share.

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Your basis in the stock depends on the type of plan that granted your stock option.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37. 60 of the gain or loss is taxed at the long-term capital tax rates.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Locate current stock prices by entering the ticker symbol. Estimate the after-tax value of non-qualified stock options before cashing them in.

Stock Option Calculator Canadian Receiving options for your companys stock can be an. Please enter your option information below to see your potential savings. To start select an options trading strategy.

Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. Open an Account Now.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Cannabis Taxes At Your Dispensary

How Stock Options Are Taxed Carta

Quarterly Tax Calculator Calculate Estimated Taxes

Printable Yard Sale Checklist Yard Sale Signs Yard Sale Garage Sale Tips

How Stock Options Are Taxed Carta

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Operation E Commerce Ecommerce Infographic Infographic Marketing Social Media Infographic

How To Calculate Sales Tax Video Lesson Transcript Study Com

Credit Card Interest Calculator Excel Template New Relocation Expenses Worksheet Printable Worksheets And Label Templates Excel Templates Printable Worksheets

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Reverse Sales Tax Calculator 100 Free Calculators Io

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Pennsylvania Closing Cost And Mortgage Calculator Mortgage Calculator Online Mortgage Mortgage

How To Calculate Cannabis Taxes At Your Dispensary

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template